Rental prices rose 0.9 per cent in May from the previous month. That brought the yearly pace of rent increases up to 8.9 per cent, with rent being the second-largest annual contributor to inflation.

Mortgage interest costs slowed very slightly to 0.8 per cent in May from April, and brought the annual pace of increases to 23.3 per cent.

This is the best summary I could come up with:

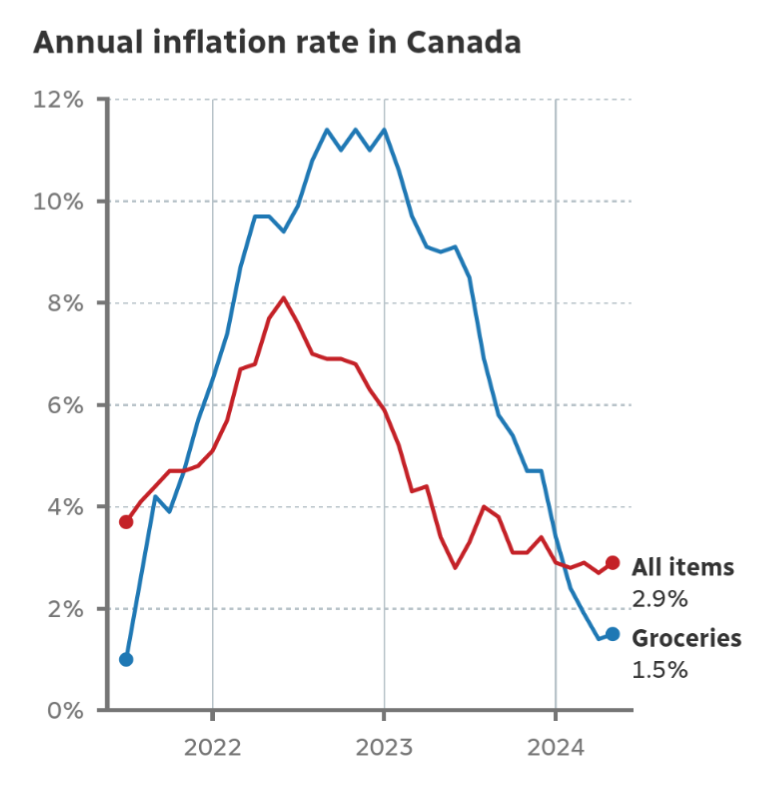

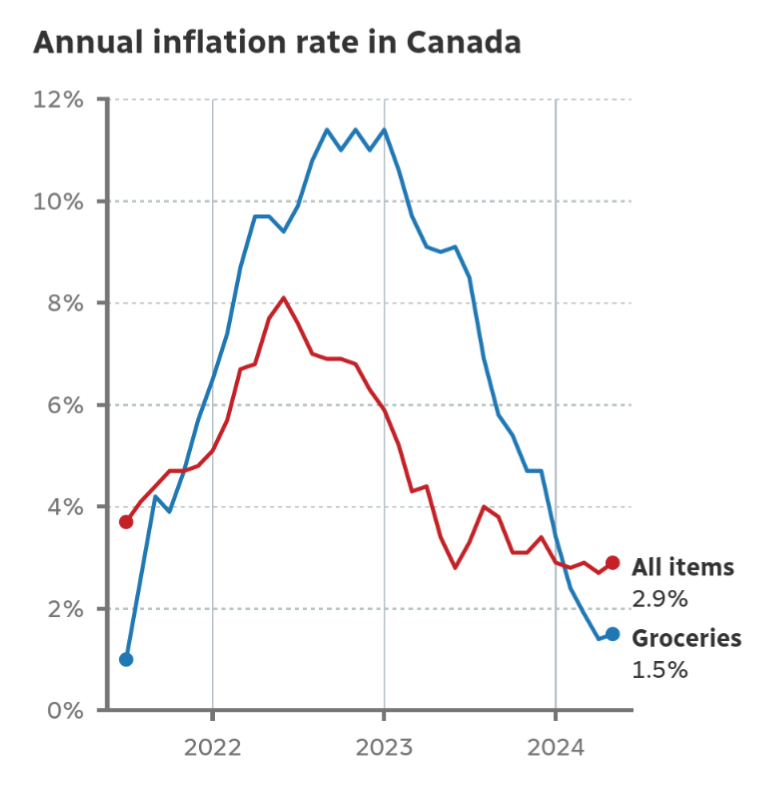

Canada’s annual inflation rate edged up to 2.9 per cent in May — an increase from 2.7 per cent in April — mostly due to higher prices for services, Statistics Canada said on Tuesday.

Prices for cellular services, rent, travel tours and air transportation grew at a faster pace, according to the data agency.

“No bones about it, this is not what the Bank of Canada wanted to see at this point, and clearly shaves the odds of a followup July rate cut,” wrote BMO economist Douglas Porter in a note.

The central bank’s preferred measure of core inflation, which strips out volatile sectors like food and energy, was also up in May — more than economists expected.

“If there was any good news here, it was that single largest inflation driver — mortgage interest costs — relaxed a bit,” wrote Porter.

Though typical of the season, it also marked the largest increase since January 2023, StatsCan said.

The original article contains 390 words, the summary contains 151 words. Saved 61%. I’m a bot and I’m open source!