Not to mention that they’re selling for $2,679.99/oz and the gold spot price is $2,500 right now. You lose 7% just by buying!

Does Canada reference weight for gold in oz’s or are you just comparing to USD things?

… on what planet has gold ever been $2500USD/oz?

So just so I can understand correctly: you read a comment, get confused about a detail (I thought Canada was metric!), do absolutely zero research, go straight to accusing the person of being wrong?

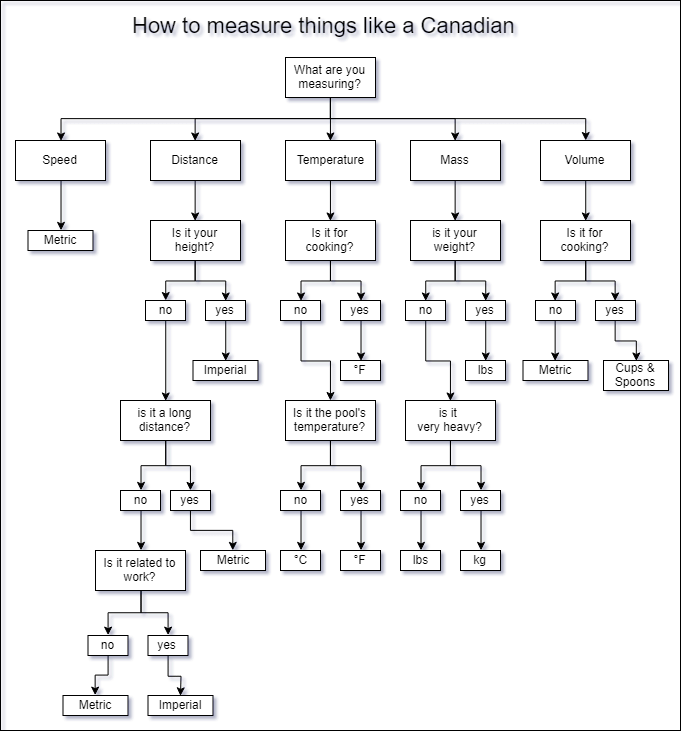

Anyways units in Canada are practically an inside joke at this point, here is a flowchart. I suppose we should add a gold path to the mass

While there’s a lot of merit in that chart, precious metals (that aren’t being used industrially) are bought and sold worldwide in Troy ounces, which are heavier than imperial ounces. Also, there are only 12 Troy ounces to the Troy pound, which is lighter than the imperial pound.

You can buy precious metals in grams in consumer markets (i.e., Costco), but all major markets deal in Troy ounces.

That chart is mostly a joke about Canadian measurement units, it’s not really meant to be taken seriously!

Oh, I know. At least we don’t use stone to measure people’s weights.

I had to use slugs for mass a few times at work and wanted to die!

Nice! Here’s some Lemmy Gold 🎖️

No, stop! You can’t just hand out Lemmy Gold like that, You’ll devalue the currency!

I bought it from Costco though 🥺

If they were really that good to hold on to, why would Costco sell them to you?

Just in case your personal style is lacking that 19th century rail baron aesthetic you’ve been wanting.

It seems that Costco is selling gold at pretty much market price. As a small investor, that is a good deal.

That said, physical gold is a poor investment for most people. You can invest in gold other ways without taking physical possession. This is often available in smaller quantities as well ( less than an ounce ) which makes it more accessible. It can be easily sold again at any time for the market price.

Owning physical gold is risky ( it can be lost or stolen ) or expensive ( you have to pay to keep it secure ). It is also somewhat illiquid which means that you are unlikely to get what you think it is worth when you sell.

When you buy physical gold, you own a hunk of shiny metal. You actually have it ( good and bad ). If you buy a gold derivative, you have a piece of paper or computer entry that says you are entitled to the financial value of gold stored somewhere else—you may not even know where.

In today’s world, the computer entry is less expensive, more convenient, more secure, and more liquid.

So, why buy physical gold?

Honestly, other than the emotional or novelty value, the only real benefit of physical gold is if you believe today’s world may disappear or radically alter. If you believe computer systems or financial markets are likely to collapse, the a computer entry is not worth much. If you believe that the rule of law may fail, the contractual obligation of a company to pay you is not with much. If you believe the government may seize your assets, having them under the control of a government controlled institution is a risk. Any or all of the above could happen if the government collapses.

If you think you may need to flee the country before the banks open, concentrated wealth that you can fit in your pocket could come in very handy.

The classic thesis for gold ownership is that it is an alternative to cash for storing wealth and that, unlike government currency, inflation does not destroy its value over time. The truth of this is complicated.

So, are precious metals as an asset class a good investment? I am not going to give financial advice but gold adds diversification to a portfolio and having to a few percent may be valuable.

Does it make sense to buy physical gold from Costco? That is a totally different question.

Regarding the societal collapse point, I really doubt that gold would be much in that scenario unless you can escape somewhere where things are relatively “normal”, in a genuine survival situation, bread is worth more than gold

Cant eat/smoke/drink gold. Spices, food, booze, electricity and the knowledge to produce those things are where the “money” is.

deleted by creator

I bought 3 x 1 oz. gold wafers from Scotiabank back in 1994 for around $400 IIRC and forgot about them in my safety deposit box. I sold them in 2010 for over $1200 each at one of those “We buy gold!” guys when I was moving for work.

Technically you can invest in gold without having physical lumps of metal, but it seemed like a thing to do when I was young, didn’t have any expenses, and gold was at a historic low. Of course now that I’m curious, it seems gold is $2500/Oz, so not sure if now is the time to invest. I guess it’s kind of like how crypto-bros said crypto was a hedge against inflation. The cost for actual physical gold wafers included some extra fees even back in the nineties, so Costco’s price above the spot price isn’t too out of line.

Anything Kirkland, just charge me already. I need it, gotta have it.

This is the best summary I could come up with:

Canadians can now buy gold bars at Costco, but one financial expert warns it might be an investment with limited return — unless you’re planning to flee the country.

He explained that “gold is awesome for people who have really unstable currencies,” and can represent an attractive, stable investment in volatile economies.

CBS reported last week that Richard Galanti, chief financial officer at Costco, said the bars were selling out within hours every time inventory was added to the company’s website.

Now, the biggest group of people who have those fears are those who were adults during the late '70s and early '80s, and they remember very specifically what happened when interest rates started hitting 18, 20 per cent for mortgages.

Go back to the yield … if you happen to have disposable income [and put it] into a savings account, you can get a decent return in interest.

Its advantage, strictly speaking, is that it is not correlated very much with stocks, bonds, real estate and other things people owe.

The original article contains 970 words, the summary contains 166 words. Saved 83%. I’m a bot and I’m open source!

This is the best summary I could come up with:

Canadians can now buy gold bars at Costco, but one financial expert warns it might be an investment with limited return — unless you’re planning to flee the country.

He explained that “gold is awesome for people who have really unstable currencies,” and can represent an attractive, stable investment in volatile economies.

CBS reported last week that Richard Galanti, chief financial officer at Costco, said the bars were selling out within hours every time inventory was added to the company’s website.

Now, the biggest group of people who have those fears are those who were adults during the late '70s and early '80s, and they remember very specifically what happened when interest rates started hitting 18, 20 per cent for mortgages.

Go back to the yield … if you happen to have disposable income [and put it] into a savings account, you can get a decent return in interest.

Its advantage, strictly speaking, is that it is not correlated very much with stocks, bonds, real estate and other things people owe.

The original article contains 970 words, the summary contains 166 words. Saved 83%. I’m a bot and I’m open source!

Bad bot, you’re seeing double!

Oops. Not ran twice.

Its advantage, strictly speaking, is that it is not correlated very much with stocks, bonds, real estate and other things people owe.

Not that the bot made a mistake, but this is wrong…

Gold drops like a rock when markets take a shit. It usually bounces back quickly – often before stocks recover, giving you a chance to buy cheap on the dip, and sell at a profit three months later, and pick up some of the stocks that haven’t recovered yet… But it VERY MUCH moves in sync with the market during times of crisis.