One in 4 middle-income new homeowners — twice as many as a decade before — are buying into cost-burdened situations.

The share of middle-class Americans who are buying wallet-squeezing homes has more than doubled in the previous 10 years.

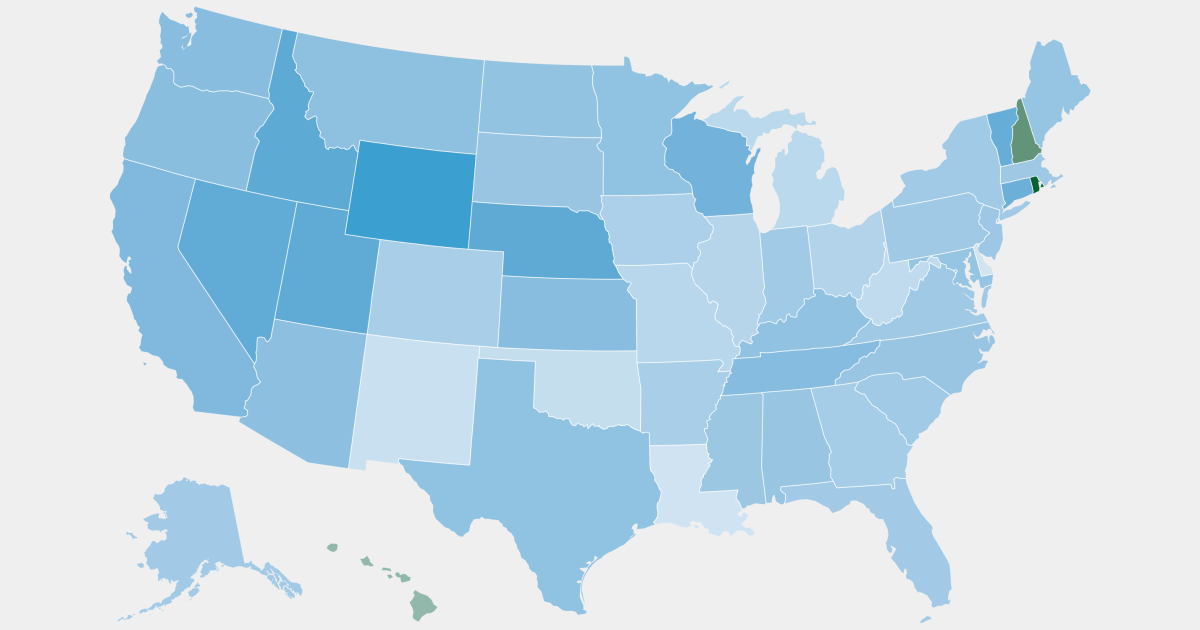

Almost 30% of middle-class homeowners bought homes with monthly payments costing more than 30% of their income in 2022, an NBC News analysis of Census Bureau data found. That’s more than twice the share from 2013, with experts warning it leaves many households with less money for groceries and emergencies and less able to get ahead in the future.

That “cost-burdened” benchmark — in which a household devotes over 30% of income to housing costs — is a widely used measure of affordability for both homeownership and renting. The Census Bureau measures housing costs against it, and the Department of Housing and Urban Development has used it for decades.

Because renting a home that’s barely enough to get by is even more expensive and will go up faster than inflation, so if you’re lucky you buy a house that’s barely enough to get by and wait for the day when it’s finally affordable since the payments don’t increase as much as inflation.

It all sounds good until your mortgage increases by 25% in one year due to increasing property taxes and insurance.

But the same happens to the rental owner, and trust me, they pass that increase on to the renters. So it’s still better than that.

No, it’s exactly the same. Actually. Not even factoring in that as a homeowner, you’re responsible for the replacement of all your appliances, your roof, paint, walls, HVAC, plumbing, water heater, and on and on. And we are talking surprise $20,000 repair.

Do you think you are not somehow paying for each and every one of those expenses as well as a healthy return to investors, in your rent?

Depending on how much the investor’s interest rates are they could be covering maintenance costs, making a profit, and still charging less than a new mortgage at current interest rates. So depending on your landlord and how much profit they’re trying to squeeze, renting might be a better option than buying right now.

You’re delusional if you think renting is “cheaper” than owning. Sure you don’t pay those piddly expenses when you’re renting, but with your own home you’re building equity and with rent prices how they are you can still save money on top of house repairs better than renting

Yeah but repairs don’t get taken care of by a landlord. When you buy a home, you have even less monthly funds available for mortgage because you also need to be saving a little for the big repair things that come up.

Renting allows those repair expenses to be handled by the landlord rather than the tenant. Renting is not inherently a worse decision than buying, there are pros and cons to both.

I own a small house that is 118 years old with plenty of issues, and the amount I put into repairs and maintenance is nowhere near the difference in what it would cost to rent a similar sized home in my neighborhood compared to my mortgage, taxes, and insurance. That includes a major sewage issue that required digging up and replacing the old clay pipes, something I couldn’t do myself.

And I’ve only owned it for 3 years, so I haven’t even gotten to a point where inflation has increased rent over the mortgage payments yet, mosly because the rental market is insane in most cities due to short-term rentals and offshore investors leaving lots of properties off the market, so landlords can charge way higher rents with so little competition. In 10 years, assuming there’s not a market crash, I’ll be way better off.

Renting only saves repair cost in the short term, spreading out those costs across time, because otherwise there wouldn’t be profit in renting. As a renter, you’re never in a position to do that saving because rent is always so much higher than mortgage cost. Even if you have to pay more for the home than the asking price like I did. I just happened to get in before the interest rate hikes is all that I benefited from.