One in 4 middle-income new homeowners — twice as many as a decade before — are buying into cost-burdened situations.

The share of middle-class Americans who are buying wallet-squeezing homes has more than doubled in the previous 10 years.

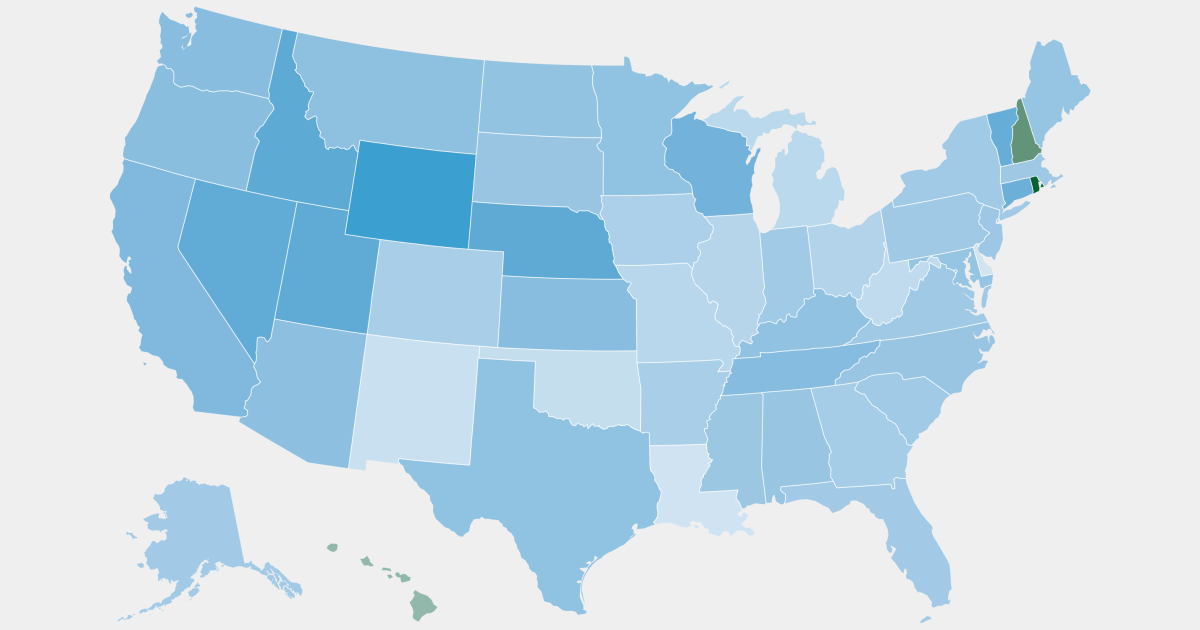

Almost 30% of middle-class homeowners bought homes with monthly payments costing more than 30% of their income in 2022, an NBC News analysis of Census Bureau data found. That’s more than twice the share from 2013, with experts warning it leaves many households with less money for groceries and emergencies and less able to get ahead in the future.

That “cost-burdened” benchmark — in which a household devotes over 30% of income to housing costs — is a widely used measure of affordability for both homeownership and renting. The Census Bureau measures housing costs against it, and the Department of Housing and Urban Development has used it for decades.

I get it. My wife and I just bought a home in Canada this summer and the pressure is very real. The prices just keep climbing and there is so much competition for everything that comes up on the market. Throw in periodic drops in interest rates and you feel like you have to pounce now or you’ll never get one.

We were very fortunate that the sellers chose us specifically because of our family dynamic and the vacancy their own family was leaving in our little neighborhood of playing/communal children. We got the house at asking price and are well within our budget, but things were looking a bit grim there until fate worked itself out. People put shit-holes up for 400k and half the time people buy it anyway. If they don’t, the price drops by 15k and it’s sold the next day.